| Date Published | October 23, 2014 |

| Company | Catch Resources Inc. |

| Article Author | Dale Galbraith |

| Article Type | October 2014 Issue |

| Category | Articles |

| Tags | Business Funding, Capitalization, Financial Management, Funding Start-ups, Raising Capital |

| HUB SEARCH | CatchResources |

70% of business failures in younger firms can be attributed to under-funding, and or, capital miss-management. This statistic alone should prove a clear warning sign and provide a bastion of sensibility to all would be entrepreneurs.

OK to be clear, for the vast majority of entrepreneurs, creating a start-up does not require you know the Fibonacci sequence of numbers or the Fundamental Theorem of Arithmetic; however it does necessitate that you pay attention to the serious consequences of under-funding your venture, or, through general lack of financial knowledge, mismanage your capital resources once in operation. The consequential evidence of overlooking the aforementioned is overwhelming. Based on widely available statistical data the vast majority of evidence suggests over 70% of business failures in younger firms can be attributed to under-funding, and or, capital miss-management. This statistic alone should prove a clear warning sign and provide a bastion of sensibility to all would be entrepreneurs. For those intrepid adventurers may I suggest the following mantra for consideration; undercapitalization is the kiss of death!

![]() For many who have started or owned businesses, ensuring adequate capital, in many cases, is easier said than done. Not pray-tell, do to lack of knowledge or understanding on the subject; goodness knows the perils of such naiveté are well documented. Rather, in part, I suggest there is a strong tendency to let our guard down when confronted with this challenge. Many of the tasks and necessities required to ‘start’ a business can be dealt with on a pragmatic basis and in most instances are done so with objective enthusiasm. However, when the subject and attention turns to financing, the stress can elevate to ‘hair-graying’ levels. There are few details during the start-up and operational phase of one’s business that strikes as much fear and anxiety in us than raising capital. Even the most seasoned business journeyman could attest to that.

For many who have started or owned businesses, ensuring adequate capital, in many cases, is easier said than done. Not pray-tell, do to lack of knowledge or understanding on the subject; goodness knows the perils of such naiveté are well documented. Rather, in part, I suggest there is a strong tendency to let our guard down when confronted with this challenge. Many of the tasks and necessities required to ‘start’ a business can be dealt with on a pragmatic basis and in most instances are done so with objective enthusiasm. However, when the subject and attention turns to financing, the stress can elevate to ‘hair-graying’ levels. There are few details during the start-up and operational phase of one’s business that strikes as much fear and anxiety in us than raising capital. Even the most seasoned business journeyman could attest to that.

It’s during this tenuous process however that our enthusiasm, and dare I say, ego, taunt our subconscious with false thoughts and confirmations. Against our best judgment and counter to sound business practice, our ‘reality index’ is challenged.  Then it happens! The mind begins to play nasty tricks on us. Suddenly it’s telling you not to worry, you will find the money so just go ahead and get started, or; you don’t really need as much as you think, or; your idea is too good to resist so additional money will be available once you start, or; sales will be adequate to fund your needs internally! And so on and so on… until finally you believe such folly and proceed unabated, not expecting this ‘compromise’ could possibly lead to the suicide note posted on the business door.

Here’s the key! And a crucial item, which cannot be over-emphasized. Proper management of existing capital and adequate funding of your business, especially in the start-up phase, are two of the most important factors attributed to long term business success, Period!

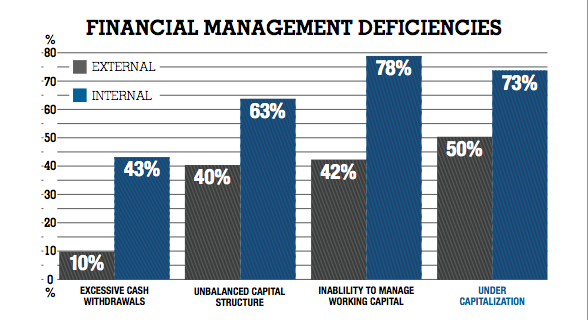

On the negative side of that coin however, lurks the ugly cousin. Improper allocation of capital combined with under-funding run virtually parallel as the two primary factors of business failures. This is of fundamental importance given that in cases where funding appeared adequate, miss-management of capital in both young and matured firms contributed equally as an ‘internal variable’ to the ultimate demise of the business. But here’s an interesting side-note, a Statistics Canada study goes on to further state, that the latter confirm the finding that; “initial problems in financial structure are difficult to overcome and continue to haunt firms as they age†(Baldwin and Johnson 1997).

With many start-up requirements absorbing vast amounts of the business owner’s time and energies, it’s understandable how would-be entrepreneurs overlook the importance of this. Unfortunately, in many cases the individuals responsible simply lack the knowledge or experience to fully understand the ramifications or importance, adequate capital has on the very survival of the firm.

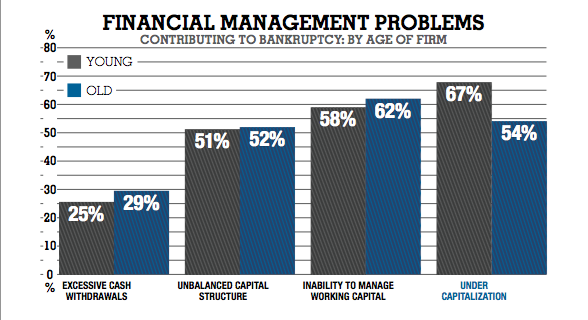

The probability of survival or failure among younger firms arguably has different causes than older firms. Over time however “firms ultimately succeed or fail as a function of their ability to create and sustain value through the deployment of strategic assets†(Learning from failure Stewart Thornhill & Raphael Amit). In addition, financial and marketing management deficiencies play a greater role in the failure of young firms, thus young firms will be more prone to failure as a function of general management knowledge, skills and abilities. Therefore, the importance of internal financial management for younger businesses in particular, cannot be overstated.

To help put this in perspective, let’s use a widely accepted acknowledgment of a really ‘big lie’ to highlight this point. You know the one, the one  told by BP about the number of barrels being leaked into the gulf. Yup, that one! Well eventually, as in all lies the truth prevails at which time the consequences of turning a blind eye becomes self-evident. Accordingly, think about the reality of not addressing or overlooking entirely the need or requirement for adequate capital as the big lie. Unlike the smoke screen laid out by BP in their ostrich-like attempt at concealing the truth, BP eventually woke up to the reality that ‘true’ numbers never lie and do eventually surface (no pun intended). If you have truly researched your initial capital requirements, or, in the case of an established entity your ongoing operational needs relative to cash flow, and have determined  a potential or realized short fall in these areas, it is incumbent upon you to ensure any deficits are adequately and immediately addressed. To take the ostrich-like approach may doom you to a similar monetary fate as BP, albeit on a smaller scale, but no less devastating to your business.

In the occurrence of a start-up, this requirement should be addressed with the same vigor and resolve one attributes to say… the birth of their child, it is that important. We’ve all heard this business analogy bantered about over the years, it goes something like this; when you are starting a business take whatever time and capital needs you have identified and double them. To some this may be considered an overstatement, however as most entrepreneurs would agree (half in jest, half with gut wrenching seriousness), it is not far from the truth. This is especially true in the universe we inhabit. The oil and gas sector is notorious for consuming capital. In fact the capital requirements for extracting oil & gas in Alberta would easily suggest that the business owner could triple or quadruple the expected capital needs.

In the occurrence of a start-up, this requirement should be addressed with the same vigor and resolve one attributes to say… the birth of their child, it is that important. We’ve all heard this business analogy bantered about over the years, it goes something like this; when you are starting a business take whatever time and capital needs you have identified and double them. To some this may be considered an overstatement, however as most entrepreneurs would agree (half in jest, half with gut wrenching seriousness), it is not far from the truth. This is especially true in the universe we inhabit. The oil and gas sector is notorious for consuming capital. In fact the capital requirements for extracting oil & gas in Alberta would easily suggest that the business owner could triple or quadruple the expected capital needs.

Regardless of the final number, it is prudent to remember that you’re not simply taking the car out for a test drive here; you’re purchasing it then living with it for a very long time, possibly for generations. In many cases, this is your first kiss, your first love, your first crack at independence; you’re hopes, dreams and life’s lessons all happily and joyously consummated into a living breathing extension of your existence. So don’t for one minute overlook the lifeblood and nourishment of this creation, that being adequate funding and proper financial management.

Given the economic engine in North America is driven largely by small SME`s (that is businesses with fewer than five employees) it is little wonder failure statistics within this group are epidemic. Fully 70% of businesses started today will not make it past two years and for those that do, the threat and reality of insufficient cash flow will continue to be an ongoing concern, one that will require constant and adequate attention.

Hey! Go ahead and take the auto out for a spin all you want, however, bear in mind that just as you maintain and care for that asset to ensure longevity, so too must you ensure the same care and attention be focused on your businesses capital and financial needs.

Hey! Go ahead and take the auto out for a spin all you want, however, bear in mind that just as you maintain and care for that asset to ensure longevity, so too must you ensure the same care and attention be focused on your businesses capital and financial needs.

This can be achieved through regular and disciplined attention to your P&L statements and balance sheet reporting and analysis.