Have you ever heard the old adage, “Beware the cost of the lowest price”? It rings true now more than ever in the oil and gas industry. People often use cost and price interchangeably, but they are two distinctly different things. Simply put:

– The purchase price of the products and services you are buying.

– The cost your business has to incur to adopt the products or services you are buying.

The lowest priced vendor for a particular product or service doesn’t necessarily mean your business will always save money and be cost effective in the long run. Without

proper due diligence, often this ‘beat up the vendor on price’ strategy, eventually bites you in the ass! You end up spending more time and money due to unforeseen issues like poor quality, loss of time, and efficiency because of a subpar product or lack of vendor performance. Ouch! So much for the cost savings you thought would be realized during the vendor vetting and bidding processes.

Who can blame a producer for demanding the best possible price, but if there are no Energy Services Companies left in line to accept and do the work what difference does it make? There are a lot of angry individuals in the industry these days, many of which feel they have been dealt, not just a lousy hand, but that the cards are stacked unfairly against them. They have experienced a myriad of personal feelings and business setbacks during these troubling times. They have witnessed the utter destruction of many long standing and successful companies, both beloved industry buyers and crucial sellers of much needed and competitively priced services, supplies and rentals. It’s been eerily similar to losing several close relatives and/or friends due to an untimely and unforeseen death or tragic accident. The industry has gone through its own form of grieving which is resetting and bringing a new meaning to the Price vs. Cost debate!

After riding so high in the saddle, and even for many who had experienced one or more downturns before, the industry by and large still couldn’t believe oil prices would drop as drastically and so quickly. A small percentage of companies had the foresight to embrace a credit risk management program to stave off their bankers and investment groups, while others were still clinging to notions of short term price decreases in the hope of longer term and continued price escalations. The strong and credit wise survived for the most part, and the weak suffered alone or disappeared in their denial.

While declining and lower prices were the enemy, along came a change of government and a massive move to the left by the NDP in Alberta. Anger was rampant in the industry over higher corporate taxes, the prolonged royalty review, climate leadership plan, stalled federal pipeline approvals, lackluster provincial pipeline support, and the investment-killing carbon tax. Other jurisdictions around the world were coping with the price issue, sometimes life and timing sucks, but the uncertainty created as a result of these ideological positions quickly transformed the enemy and anger from low prices toward the NDP government. The cost of doing business increased while the prospect of attracting new investment all but dried up. More companies fell by the wayside!

The normal reaction to feelings of helplessness and vulnerability is often a need to regain control. If only we had sold, if only we had hedged, if only we had negotiated a better price, and if only we had a lower cost structure. In order to survive, or postpone the inevitable, many companies were forced to cut staff, reduce salaries, abandon contractors and renegotiate service agreements. The burden was being shared by all, but depending on your perspective, no one could really agree on who was taking the greatest hit! Forced lower prices ensued, at the cost of more fallen companies.

When are prices going to turn around? When will the governments come to their senses? Depression set in with all of the displaced workers and previous owners of now defunct companies. Plenty of sadness and even more regret. Those who are left attempting to still make a go of it in the new world of $50 oil are fortunate, but by no means clamoring for joy. They are expected to do way more, with way less. In order to do so, the industry has to reinvent itself from the top down, not only to just survive, but instead to thrive in this price environment. The cost of failure is all too close for comfort.

Here’s where the oil and gas is sitting today. Resigned that government policies are not going to change, at least for a few more years. Prices are likely to stay at or near current levels. Lower priced services, supplies and rentals are the new reality but likely can’t go any lower. Companies are now willing to find better ways of doing business. They are seeking out productivity improvements in all aspects of their business processes and procedures. Cost efficiencies result and profitability will be restored. The new business norm for the foreseeable future in the oil and gas industry.

We have all paid the price, but at what cost? The oil and gas industry is not a race to the bottom. It’s a race to uncover even more ingenuity and determination to rise above this adversity and uncertainty. It fuels our companies, feeds our families and powers the Canadian economy!

Kevin Turko

CEO

Oilfield HUB Inc.

kevin.turko@oilfieldhub.com

403.537.6561

Originally published in the

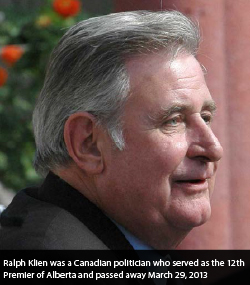

As Premier for 14 years, King Ralph helped start the explosive growth in the oil sands, retired the provincial debt, and wiped out the deficit. He did so WITHOUT RAISING TAXES. Let’s not forget, when he started, Alberta had the highest deficit per capita in Canada. He fought the National Energy Program (NEP), admonished creeps (okay he wasn’t ALWAYS funny) and bums, and had big fiscal wins in the first half of his career. Klein had his own vision and version of economics. Even though interest rates were low, he committed to paying off the provincial debt. There are different schools of thought on this, but the bottom line is, if he said he was going to do it, he did it. Good old cowboy ethics at work!

He certainly had his challenges, but what laid the ground work for him being a four term Premier was his unique ability and willingness to own up to his mistakes. He had no issue working hard to fix his own errors and flaws, and that is a mindset lost on current politicians in Alberta. It’s just too bad that Mr. Klein seemed unable to build long term vision and goals for the province.

That was Klein, but this is more about a tale of two cities or, to be more accurate, a comparison of a state and a province. The recent Fraser Institute report called, “One Energy Boom, Two Approaches”, details the differences and trends between Alberta and Texas. They even borrowed a famous Klein quote, “We do not have a revenue problem; we have a spending problem”! We DO indeed have a spending problem, and one could argue that, except for Klein, we always have. The report highlights where the two oil driven economies have differed over the ten-year period ending in 2014.

King Ralph helped start the explosive growth in the oil sands, retired the provincial debt and wiped out the de cit. He did so without raising taxes.

Texas and Alberta both benefitted from high global prices for their natural resources. People and capital WANTED to come to both places. Taxes were designed to drive growth in the sector. If we look at the numbers now, however, Alberta is in a much worse place than Texas, and it will only worsen as we move forward. Even when considering things like transfer payments, we have still underperformed. Certainly, the Texas economy does not rely on oil and gas to the extent that Alberta’s does. In 2014, shown as a percent of GDP, oil in Texas accounted for 12.3% while oil in Alberta was at a whopping 27.4%! THAT is only an issue if you do not PLAN for the cyclical nature of oil and gas.

Alberta has again failed to consider such long-term planning. At the end of this year, Alberta will be in a net debt position! The report goes on to highlight that in the space of TEN years (2009- 2019) Alberta will move from a net asset position of + $30 billion to NEGATIVE $30 billion. Those should be scary numbers for all of us. Do any famous Alberta bumper stickers come to mind?

Let’s get back to the whole concept of a revenue problem versus spending problem. During the ten-year period of the Fraser Institute report, Alberta’s spending on public programs increased 49% per capita while the increase in Texas was 37.3%. Public sector employment growth in Alberta was more than double that of Texas, 2.6% against 1.2%. We have already been told the Alberta government plans to continue to increase the deficit for many years to come! At what point must the piper be paid? We also need to remember the deficit and the debt do not necessarily reflect 100% of the debt and spending going on either. The true picture is really worse than it appears, because deficit numbers typically reflect only the servicing of the debt being incurred and not the full value.

Much like in the previous boom periods, we chose NOT to continue saving for a rainy day. The current governments, both federal and provincial, are choosing to SPEND MONEY THEY DO NOT HAVE. I believe they could both learn from Klein’s somewhat simpler view of use of funds. When you are making less money, you SPEND LESS MONEY. When you are making MORE, you spend a little more, but you also SAVE MORE as well! We are, unfortunately, well past that stage, so what now?

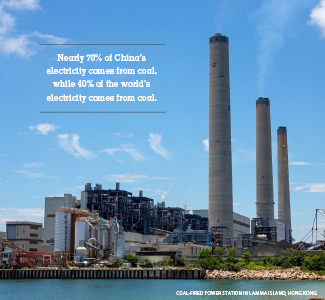

This is where the Make Canada Great Again connection comes. Texas displayed fiscal prudence and responsibility when spending public funds. We need to adopt more of that kind of thinking. With Trump in power, the coal industry WILL last a few years longer in the USA. Our government NEEDS to understand that dynamic, or we will price ourselves out of the energy market. Solar, wind, and other renewables only exist with large subsidies, and this government will never come clean about the total cost even IF they do come to understand it. Oil and gas creates jobs, drives growth, and contributes to the available funds for public programs and such subsidies. While “two out of three ain’t bad” may have been a great title for a song, it is not so great when it comes to pipeline approvals. We will also have the challenges of getting either line built. If we were going to pick two, they should have been the ones headed toward tidal water and not South.

It sounds like President-elect Trump wants to “pull a Ralph Klein” and change regulations on oil and gas to create jobs and bolster growth. Create an energy climate that ATTRACTS investment rather than scares it away. I am sure he is not

a complete climate denier, and once he has access to all the regular briefings and science, he may see that. In the meantime, I think he will do everything possible to help the coal, oil and gas, steel and other industries recover.

Alberta and Canada had better be prepared to take advantage of this swing in policy and fully comprehend the effect it will have on us. We may be bigger, and we may be on top, but Trump is now in charge of one of the largest economies in the world, and we must plan with that in mind. We must understand and appreciate that, with ten times the number of residents and about nine times the GDP, the USA can determine where we go next. After all, it was Americans who basically started our oil and gas industry (think back to Turner Valley and Leduc), and they still exert massive control over it.

Whatever your political stripe, perhaps we can learn from the new leader of the free world? Or, at least, PLAN to extract whatever benefit we can while minimizing the damage to Canadians.

As 2017 approaches, the Canadian oil and gas industry is part of the national conversation like few times in our history. Our responsible, ethical, world leading industry is at risk of being permanently damaged by an orchestrated attack from radical environmentalists. Over the past decade, millions of dollars have been spent by well-organized, media savvy ENGOs to position Canada’s oil sands in popular culture as the focal point of climate change, dirty oil, and corporate greed. They have managed to place several of their key representatives, such as Tzeporah Berman and Gregor Robertson, in important government roles in Western Canada and are now using taxpayer dollars, in addition to their considerable private funding, to drag the Canadian energy industry through the mud in front of the world.

Ironically, at the same time, Canada’s oil and gas industry continues to lead the world in responsible and ethical production. The oil sands itself has seen a 30% reduction in carbon emissions per barrel since 1990, demonstrating the industry has been working on carbon reduction even before carbon reduction was cool. All told, Canada produces less oil per day than the state of Texas alone and amounts to 1.6% of global greenhouse gas emissions. Canada uses the royalties

from the sale of oil and gas to fund hospitals, schools, and parks, and the industry itself provides approximately 500,000 Canadians with jobs. Canadian technology and regulations for things like pipelines are used around the world as models of best practices in oil producing areas, and Canadian trained engineers, geologists, and rig workers are highly sought after. Yet, in our own country, there continues to be a very vocal, emotional, and prominent group of people who want to shut our industry down.

As Vivian Krause points out in her recent article, The Great Green Election Machine, it would appear Canada has been duped. Our country’s greatest virtues-selflessness, charity, responsibility, compassion—have all been taken advantage of using misinformation and celebrity culture to the point where Canadians are fighting amongst ourselves over a problem the rest of the world seems to have, based on their actions, bestowed on Canada and Canada alone.

Yes, many countries came together to ratify COP21 in Paris in 2015. Since then, however, the United States has lifted a 40 year ban on oil exports and built 16,000km of pipelines. China, while trying to reduce its dependence on coal, continues to build new coal facilities at a rapid pace. Germany, a country praised for its renewable energy policies, is moving back to natural gas in many areas due to high costs and inefficiencies in wind and solar. Nigeria continues to allow the uncontrolled release of methane from its production facilities. Saudi Arabia, the world’s wealthiest oil producer, continues to see class and wealth inequality on a scale unheard of in Canada. The actions do not match the words.

There is a role for Canadian oil and gas in global markets, even though the world will continue to shift toward renewable and lower carbon energy forms and as clean technology evolves over the coming decades. Canada’s role should be to offset and displace environmental laggards in oil and gas production not be shut down from participating altogether.

In 2017, we are forecasting a modest increase in the amount of wells and a WTI price of between $40-$60 USD. Given the climate described above, the Canadian oil and gas industry has an uphill battle ahead even with a recovery in the price of oil. The recent election of Donald Trump in the United States, however, could be seen as a huge opportunity for Canada. Trump has stated, on multiple occasions, his support for Keystone XL and favoured approving the pipeline within his first 100 days as President. Our Prime Minister should be using his first meeting with the new President to reinforce Canada’s support

for North American energy security, which requires Canadian oil to have greater access to the US market. Keystone XL would provide an additional one million barrels per day of Canadian crude to the US and significantly reduce current price differentials. It would mean better profits for Canadian companies, higher revenues for Canadian governments, and more jobs for Canadian workers.

Additionally, the election of Trump should force the federal and Alberta government to reconsider their position on carbon pricing. The new Trump administration and Republican controlled congress will likely move the United States away from Obama’s commitment to the Paris Agreement on climate change or, at the very least, significantly slow its progress. As a result, Alberta’s new carbon tax will no doubt push capital away from Canada toward oil and gas investment opportunities south of the border.

Contrary to what our detractors would like us to think, the oil and gas industry is not dying. The International Energy Agency (IEA) forecasts the world will consume almost 40% more energy by 2040, and fossil fuels will make up 75% of the energy mix. This energy growth will be driven, almost entirely, by the emerging economies of Asia, the Middle East, Africa, and Latin America, which are home to more than four-fifths of the world’s population and a rapidly expanding middle class.

In 2017, there are huge opportunities for our sector, but in order to realize these opportunities, a few things must happen. First, federal, provincial, and municipal governments need to seriously address business competitiveness in the face of incredible changes in American politics. They must accept our industry is important and recognize it is crucial in providing jobs and tax revenues for all Canadians.

They must start treating our industry, and the people and families who rely on it, with respect. They must understand Canada’s role in transitioning toward whatever the future of energy may be. They must realize transitioning from a position of financial strength and technical ingenuity will enable us to continue to be an energy leader able to produce, consume, and export affordable, reliable energy so we do not become an energy follower forced to rely on others for supply and paying prices we have no control over. They must approve pipelines and allow our world-class products to be sold on the world market for the benefit of everyone involved.

Secondly, Canadians who support and understand our world-class oil and gas industry must work hard to share the truth about what we do. Rather than dying, our industry is evolving, improving, and staying competitive as it always has. We must work hard to show the rest of the country and the world why we are the best and why our industry is so important to our quality of life and high standard of living. We need to be unapologetically proud of what we do and not let our detractors continue to carry the conversation.

The status quo will not provide Canadians with a strong economy and high paying jobs nor will it encourage them to stand behind our industry with support and compassion. The year 2017 can be a year that sets Canadian oil and gas apart for what it really is. Let’s work together to make it happen.

Alberta Energy Regulators (AER), formerly Energy Resources Conservation Board (ERCB), implemented a revised Licensee Liability Ratings (LLR) program effective May 1, 2013. These changes resulted from extensive consultation with industry and were supported by Canadian Association of Petroleum Producers (CAPP) and the Explorers and Producers Association of Canada (EPAC). The LLR program applies to all upstream oil and gas wells, facilities and pipelines.

Alberta Energy Regulators (AER), formerly Energy Resources Conservation Board (ERCB), implemented a revised Licensee Liability Ratings (LLR) program effective May 1, 2013. These changes resulted from extensive consultation with industry and were supported by Canadian Association of Petroleum Producers (CAPP) and the Explorers and Producers Association of Canada (EPAC). The LLR program applies to all upstream oil and gas wells, facilities and pipelines.

The LLR program was developed to prevent Alberta taxpayers from assuming liability for suspension, abandonment, and remediation and reclamation costs from defunct licensees. Currently there are over 60,000 inactive wells in Alberta and this number will increase significantly as the resource depletes.

Some of the pressure to reform came from Alberta’s Auditor General, industry, land owners (a large portion of it being the Crown) and environmentalists. The program is designed to be phased in over a three year period – May 2013, May 2014 and May 2015.

In essence, the LLR is a ratio of the licensee’s deemed assets value to its deemed liabilities. It is based on certain parameters set by the AER under Directive 006 and Directive 011. Liability Management Rating (LMR) is a ratio of a licensee’s eligible deemed asset in the LLR factoring in Large Facility Liability Management Program (LFP) and Oilfield Waste Liability Program (OWL) to the licensee’s deemed liabilities.

The Licensee is required to maintain a monthly ratio of 1.0 or greater, failing which; a security payment is required to be deposited with AER. Failure to comply with the LLR program can result in application of a non-compliance fee or suspension of operations.

THE MICRO-JUNIORS ARE DISAPPEARING

“Many of us recall when the family farmer could make a living farming a relatively small section of land. If we fast forward to today, it is obvious the vast majority of these small farms have disappeared. They are no longer economically viable. This scenario is now playing out within the micro-junior oil firms. The squeeze is on and many will not survive unless they adapt to the new reality. Economy of scale is critical.”

“Many of us recall when the family farmer could make a living farming a relatively small section of land. If we fast forward to today, it is obvious the vast majority of these small farms have disappeared. They are no longer economically viable. This scenario is now playing out within the micro-junior oil firms. The squeeze is on and many will not survive unless they adapt to the new reality. Economy of scale is critical.”

The LLR directive requires every licensee to maintain a monthly LMR of 1.0 or greater.

These changes, as applied to calculating the LMR, will result in significant increases in security deposits payable to AER by companies having a LMR of less than 1.0. In particular it may cause significant hardship to junior oil and gas companies that are trying to either develop their assets or increase production.

Companies with a lower LMR can improve their ratio by increasing production through acquisition, reactivating wells or drilling new ones. Another way of improving LMR is by reducing liabilities through abandoning and reclaiming non-producing wells and facilities. Both of these initiatives require capital.

The AER estimates the number of companies in breach of LLR will increase from 88 to 248 within the three year phase in timelines and the amount of deposits with AER will increase from $13 million to $297 million. This will affect micro-juniors if they don’t have access to capital to take remedial measures to increase their LMR.

The micro-juniors will be devastated the most if they don’t pay attention to the impact of depleting resource to increasing liability costs in determining their LLR.

Another significant impact of the LLR applies to transference of well licenses. The transferor and transferee are each required to have a LLR of 1.0 or more before the transfer of license is approved by AER. Any party having a LLR of less then 1.0 will be required to post a security deposit prior to transference being approved.

The formula for calculating the LMR will change over the three-year phase-in plan as follows:

• Deemed well abandonment liability value will increase annually by one-third the 2012 values in May 2013, May 2014 and May 2015.

• Deemed assets value will increase annually by one-third of 2012 industry average netback values in May 2013, May 2014 and May 2015.

• Present Value and Salvage (PVS) factor changed to 1.0 for all active wells and facilities from current 0.75 as of May 2013.

• Facility abandonment and cost parameter for each well equivalent will change from $10,000.00 to $17,000.00 as of May 2014.

• Reclamation costs will increase by 25% for wells and facilities as of May 2014.

In 2007 there were 94 publicly listed junior oil and gas companies in Western Canada. By 2013 that number had dropped to 49. Similarly private juniors are also being squeezed out of the market due to the added LLR burden on their cash flow outlook. A recent Niven Fischer study predicts some 500 companies could have LMR of 1.0 or less by 2015.

• Pay the required deposits

• Present a plan to the AER to get back on side

• Or, turn over the keys

This LLR trap, however bleak, also provides great opportunities to companies that develop strategies to take advantage of firms with low LMR. Some of these opportunities include:

• Capital: Companies with access to capital will be better positioned to take advantage of assets on the market as a result of low LMR. Some companies will be forced to shed low LMR assets to improve their LMR. Others will have to sell high LMR assets to raise capital for security deposits to AER or use capital for abandonment or drilling program.

• Acquisition and Mergers: Companies with higher LMR will be in a stronger position to negotiate acquisition or mergers with companies that struggle with low LMR.

• Farm-in: Companies with high LMR will be in a stronger position to negotiate farm-in agreements, in particular the royalty rates.

One of our managers asked me how to change morale within his department the other day. I have witnessed the ebb and flow of energy within the companies and departments I have led. There is nothing more debilitating to a business than low morale. The manager asking for help felt the deterioration began with new personnel during a busy period. He felt his people were running on empty and he was concerned he would lose his best people just when he needed them most.

One of our managers asked me how to change morale within his department the other day. I have witnessed the ebb and flow of energy within the companies and departments I have led. There is nothing more debilitating to a business than low morale. The manager asking for help felt the deterioration began with new personnel during a busy period. He felt his people were running on empty and he was concerned he would lose his best people just when he needed them most.

The first thing I did was congratulate him for even noticing. The number one mistake a manager can make is not paying attention to the state of mind of their employees. We had to start working on the details of how he thought it had happened. We wrote out some possible root causes and set a plan to move forward.

In my opinion, morale is fixable if you have the wherewithal to not accept it when it is negative. The biggest challenge for people who are too linear or task oriented is that morale cannot be fixed with a tool or a set of instructions. It takes guts and it takes grit.

In my opinion, morale is fixable if you have the wherewithal to not accept it when it is negative. The biggest challenge for people who are too linear or task oriented is that morale cannot be fixed with a tool or a set of instructions. It takes guts and it takes grit.

Let’s use an analogy here and say that “every company is a puzzleâ€. The thing about puzzles as we all know is that they end up making a picture. Each puzzle makes a different picture and can be built or broken down into its own set of pieces. If we use the puzzle as an analogy for business, you may assume that every company is like a snowflake and that no two are alike. If there is anything that my experience has taught me, it’s that it doesn’t matter what makes a company unique. What matters from a management perspective is that you are building and coordinating the functions that allow your puzzle picture to be built. The reason the puzzle analogy works so well is the breaking down of core competencies and functions within an organization.

The act of putting a puzzle together or taking it apart is not dependent on what the picture looks like and it is not really a factor that the puzzle pieces are different either. Yes, there are things that make it unique, but you can use the same set of mind tools to build any puzzle, and the variables are going to have similar outputs even though those variables can be very different. A puzzle can be built because one piece fits into another and you need to use your past and present experience to make it all fit together. You need to use your senses, you need to pay attention to patterns, and you need to know what makes each piece unique.

Businesses and more importantly the people within your business are exactly the same. The setting changes, the type of work changes, what you build, create, or provide as a service changes, but the function of running any business is static just like putting together a puzzle. The culture, personalities, prevailing attitudes, personal back stories, and motivations are all just puzzle pieces, and you can use mind tools and basic skills to make them fit together and make a picture.

The culture, personalities, prevailing attitudes,personal

back stories, and motivations are all just puzzle pieces,  and you can use

mind tools and basic skills to make them fit together and make a picture.

When you build a puzzle, many will follow a set format. You empty the box; put all the pieces facing up, look for your corner pieces and end pieces, then you step back and look for colour consistencies, and then the construction begins. Your people puzzle is similar. I always follow the 10-80-10 rule. You have 10% that are your top performers, the people you can’t live without. The 80% in the middle are the people you need to get the job done. The last 10% are people who are under performers or people you don’t want or haven’t committed to your team. If you have the power to remove that 10% you should, but often circumstances prevail that may make that impossible or difficult to do.

Remember a team should never be static. If you are putting a puzzle together, you are trying things. Sometimes a piece looks like it fits and it doesn’t, so you stop, look for a new piece, and try again. When you build a puzzle, you aren’t afraid to fail, and as a manager you have to be willing to try things that may not work when it comes to morale. You have to be willing to try and fail, and keep trying until the pieces go together. It is the single most important job you have and companies don’t recognize it. Make sure when you fail to admit it. Tell everyone who will listen, especially those that work for you. When people see that you are trying to fix a problem, they may naturally start to root for you, and in turn their morale will rise, even if only a little, because they see you care.

Remember a team should never be static. If you are putting a puzzle together, you are trying things. Sometimes a piece looks like it fits and it doesn’t, so you stop, look for a new piece, and try again. When you build a puzzle, you aren’t afraid to fail, and as a manager you have to be willing to try things that may not work when it comes to morale. You have to be willing to try and fail, and keep trying until the pieces go together. It is the single most important job you have and companies don’t recognize it. Make sure when you fail to admit it. Tell everyone who will listen, especially those that work for you. When people see that you are trying to fix a problem, they may naturally start to root for you, and in turn their morale will rise, even if only a little, because they see you care.

If you have morale problems or people problems, they can be fixed. It takes time and you may need to relate it back to something you know. If you’re an engineer or a carpenter then equate it to building something. You have to know that everything you build doesn’t happen miraculously and that it takes time. Spending time working on morale will net results far greater than you can imagine; I guarantee it. If you want to sell more, want to build more, want to make customers happier, on and on. I know you may have been looking for a silver bullet here and I didn’t give it to you, but swing by the shop one day and we will talk. Every situation has a resolution, but you have to know where to start, and I love spending time solving people puzzles…

Tom McCaffery

General Manger

Plans Fabrication

This article originally appeared in the Â

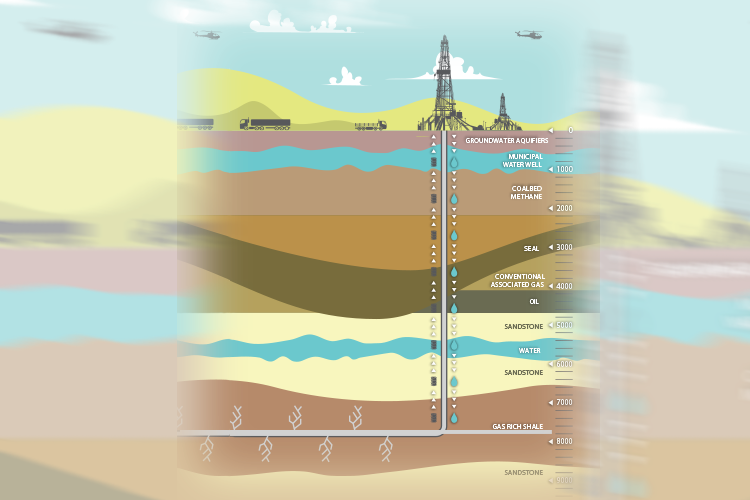

With the natural gas market threatening to mount a comeback, our industry could be in for yet another major shift. The shale gas revolution has gone through several stages already with the skeptics and promoters each being right about certain aspects of the plays. The shale revolution in natural gas was brought to us almost exclusively by the introduction of a disruptive technology, the first multi-stage fracture stimulations.

We all know what happened next, with short term storage filling up for several winters due to the prolific initial production rates from these shale gas wells and the rush to drill and hold lands. That combined with the lack of markets for the industry’s gas outside the reach of our pipeline networks lead to the price collapse which ensued. Natural gas fell significantly out of favor as it has done before with deregulation of market in the 1980’s.

Looking back to before the days of shale gas and the common thinking that conventional gas projects, which relied on higher and higher pricing, would be the way of the future. Coal bed methane producers were chided for using prices above $7 mcf in their economics. But with spot prices at the time they could claim to be conservative with their estimates. Fast forward a few years and it is hard to imagine how we once thought that way.

Looking back to before the days of shale gas and the common thinking that conventional gas projects, which relied on higher and higher pricing, would be the way of the future. Coal bed methane producers were chided for using prices above $7 mcf in their economics. But with spot prices at the time they could claim to be conservative with their estimates. Fast forward a few years and it is hard to imagine how we once thought that way.

As an industry we are of two minds when it comes to natural gas. The oil sands producers use it as an input, and the conventional producers see it as an end product for sale. These two mindsets are diametrically opposed and speak to the struggle we will continue to have in maximization of our resource base. One example that comes to mind is Steam Assisted Gravity Drainage oil wells, which have done very well, while natural gas prices lagged. A resurgence of natural gas prices will surely strain the recent economics of this type of project.

At Pajak Engineering, our clientele direct the type of wells we work on. These well types have changed with the changing times and our gas focused clientele are requesting assistance with increasingly challenging deeper drilling projects targeting liquid rich plays which serve to offset the economics of the natural gas itself.

As the market drives to more and more complex wells, it appears the days of drilling swaths of inexpensive dry shallow gas wells seems far behind us. However, the perfect storm of circumstance could change the industry yet again to revitalize shallower plays which have not seen as much activity in close to a decade. Having served the industry for nearly 50 years Pajak has seen the industry change many times, and has a history of adapting well. Some things remain constant however, such as our commitment to integrity, good oilfield practices, and the safety of our personnel.

Whether the next big change comes fast or slow, it is sure to come. As it stands now it would appear that economic forces rather than technological change are likely to cause the next major shift in where we focus as an industry. Regardless of the timing, we at Pajak will be sure to stay ahead of the industry trends to aide our clientele with their toughest drilling and completions projects.

Whether the next big change comes fast or slow, it is sure to come. As it stands now it would appear that economic forces rather than technological change are likely to cause the next major shift in where we focus as an industry. Regardless of the timing, we at Pajak will be sure to stay ahead of the industry trends to aide our clientele with their toughest drilling and completions projects.

I have always been a strong opinionated person to say the least, so in reading this, you may be offended. However, you may realize the truth behind the person, and possibly understand my position, as President/ CEO of Stormhold Energy Ltd. Leadership starts with full comprehension of what that specific term means as CEO and how you can employ it to protect the company and yourself.

Back in 2009, when Stormhold Energy Ltd. was founded, our small startup company emerged instantly as a major land holding entity in east central Alberta. At that time, our brilliant Premier Mr. Ed Stelmach, who held this title in Alberta from 2006 to 2011, raised the royalties that oil and gas producers would owe the government from producing wells. This strategy was an effort to capture more of the revenue that was being lost through the tax optimized energy trusts.

However, the energy producing establishment banded together to boycott the province’s land sales in 2009 in an attempt to force a revision in the policy by depriving the government of any revenue from land sales.

Our story, which will certainly become part of Canadian history based on our land position, was outside of our partners in Calgary due to the fact we were not the “gum†under the shoe of the so-called Calgary Oil Industry Leaders. We took the opportunity and ran with it, angering a lot of our colleagues and business associates along the way. Needless to say, I didn’t give a crap due to my competitive nature and willingness to succeed.

At the time, Stormhold Energy Ltd. acquired 295 sections of mineral rights over 188,800 acres of prime resource opportunity. As of today, having released some 65 sections, Stormhold Energy Ltd. still holds over 230 sections and over 150,000 acres with 19 plus zones in the same area of Halkirk and Stettler, Alberta.

I have been asked many questions, and with hesitation, I have answered honestly and to the best of my ability. But frankly, I didn’t care to answer or share our story until today, with outsiders.

In all honesty, I enjoy looking into the eyes of competitors who have over paid and have followed the so-called ‘Industry Leaders’ with deep pockets of Shareholder capital, who do not care whether they followed the corporate Governance or company policies.

Having said that, I have been asked and gracefully answered:

- Who raised $13.5 million?

- How could more oil exist right under the noses of the established major producers in an area that has had over 4,500 wells drilled and produced 900 million barrels of oil?

- How was this land position acquired without debt, banking relationships, and any external financial help?

- How could the price of our land position increase from $1.3 million in 2009 to today’s going rate of $300 plus million in 2013?

- How is it that a tiny company, with no banking relationships to speak of, could be in a position to become a medium sized oil and gas producer in such a short period of time?

Pondering whether to answer or not, I hesitate trying my best to make the person asking the question as nervous and uncomfortable as possible. This strategic approach as I call it, is to get the edge on our opponent and gain additional joint venture interest from the geologists, geophysicists, and CEOs who know everything there is to know in the area. At the same time, they look star struck while reviewing our technical data we have worked so hard to compile.

I believe companies should surround themselves with hardworking industry influences, dedicated professionals, and technical experts, which we have within our contract consulting personnel. Stormhold Energy Ltd. seized the opportunity to acquire a substantial land position in east central Alberta, even though we made a lot of people mad during the process of obtaining a great land package. We are amidst companies producing upwards of 100,000 BOED, such as crescent Point, Apache, Harvest Energy, Encana, Devon, PennWest and Husky to name a few.

Keep in mind, two of the above companies made us an offer we had to refuse due to the fact they requested all of our acreage and data at a price far below industry standard. That kind of deal was not in our best interest.

In 2010, we implemented a strategic drilling program targeting deeper formations based on years of technical data acquired and industry expert opinions. We think of ourselves as a ‘deep play’ with low hanging fruit – low cost shallow Viking and Mannville targets as well. It is safe to say we have more technical data in the area than most, if not all, privately held companies of mutual interest.

Looking back, what was exciting for Stormhold Energy Ltd. at the time, turned into a challenge as our past partners did not meet the drilling obligations they committed to. As President and CEO, I had the harsh job to not only end the tarnished relationships with the joint venture partners, but I also had to inform our shareholders.

In one of the most challenging economic environments in decades, we acted swiftly and decisively to adjust our cost structure and working capital to market conditions, while continuing to invest in our future.

We did this to make sure we emerge as a stronger, well positioned company to capitalize on future economic growth, while at the same time raising additional capital to expedite our drilling program. The effects of our actions became increasingly visible as we dissolved our joint venture partnerships, which consolidated our land position.

Despite our efforts of advancing our business plan to produce from multiple zones potential and sell our assets, we ran into what I call a “minority challenged shareholder dispute.†Let me say this: everyone is an expert in business, but yet most don’t have an entrepreneurial bone in their body, or they would have done what we did themselves years ago.

What frustrates me the most, is the lack of respect the work and dedication of taking our small company from $375.00 to the potential of $300 million has earned. Not to mention the $110 million offer to purchase the company outright, just months ago. I tell most, if not all, our critics to feel free going to the local Alberta Registries and give it a go on your own; I would be happy to invest in your opportunity and criticize every move you make.

These criticisms take away from our day to day activities and become a distraction at most. These experts who criticize daily, or even yearly during Annual General Meetings (AGM), don’t realize the capital involved to battle constantly, nor the capital involved moving the company forward while fighting their stupidity.

At times, my response is simply: NO. The $20,000.00 you invested in 2010 is not still in our account and did not drill our first well. These experts seem to think our technical team and management seek only minimal compensation working 16 hour days and countless weekends to feed our families. They do not realize the dedicated man hours involved and the countless struggles it takes to increase the company’s position, while being rewarded with criticism.

That being said, we move forward and welcome more positive comments that assist our vision and mandate. Our team and legal counsel are second to none, and are truly dedicated professionals who always work in the best interest of all.

Today, Stormhold Energy Ltd. is a simpler and more agile company. compared to previous years, our position has strategically increased due to our ongoing technical data and resource development our team continuously calculates on a weekly and monthly basis.

We have tackled many hurdles without sacrificing our longer term strategic ambitions. We continued to invest in technical support and innovation that reassess our resources within our area of mutual interest. We continue to work with industry leaders and technical specialists who complement our position.

As a sign of confidence in our future, we have evaluated our large land position and continued to grow our resources. Our goal, which we have never strayed from, is to provide a sustainable company that brings the best value to our shareholders, while respecting our industry partners.

Our board and shareholders have set our mandate to develop and increase our asset base that will bring the upmost value to our team. Overcoming challenges in the oil and gas industry in Calgary, Alberta comes with rewards and frustration, yet determination prevails.

I enjoy the stresses of Calgary business, and I will always fight for what I believe in. Protecting our team from outside distractions weighs heavily on a person, yet a positive outcome is very rewarding. Our industry is damaged and corrupted to say the least, and I have experienced it firsthand. Please follow my column next month as I will touch on the Calgary elite oil and gas leaders, and how they influence market conditions and company stock transactions.

AFTER FOLLOWING IN HER FATHER’S FOOTSTEPS

Tiffany Armitage, President of Armco Resource Management Company (ARMCO),  runs leading edge manufacturing facilities providing high pressure hose assemblies and fittings with locations in Calgary and Leduc, Alberta, Canada. Transitioning from film set designs to a typically male dominated oil patch supply company surprised not only her peers, but also her father.

runs leading edge manufacturing facilities providing high pressure hose assemblies and fittings with locations in Calgary and Leduc, Alberta, Canada. Transitioning from film set designs to a typically male dominated oil patch supply company surprised not only her peers, but also her father.

Tiffany’s dreams were not of manufacturing hose assemblies and working with the oil patch and construction industries. She worked in beautiful downtown Vancouver, B.C. as a film set designer and a personal assistant to movie personalities such as ‘Charlie’s Angels’ actress Kate Jackson. Taking a break between films, Tiffany travelled to Calgary to spend a couple of weeks with her parents. Little did she know, fate and a persuasive father would turn her career into 18 years in manufacturing and the ownership of her own company.

Her initial thoughts were not of oil rigs, heavy trucks, D-10 bulldozers, and men in hard hats. Her father, Dave Armitage, challenged her to learn a “real business†from the bottom up. Soon, she found herself driving trucks delivering 1,000 pound loads of choke and kill and rotary hose to drill sites. She did shipping and receiving, built hydraulic hose assemblies, and swept the floors. After completing a number of finance courses, she moved on to procurement and inventory control, accounting, sales, and finally Operations Manager.

After her father’s retirement and sale of his interests, Tiffany decided to venture out on her own. Armed with a five-year plan, a sub-leased building, determination, and an army of friends, welders, electricians, and pipe fitters, ARMCO was born. Her number one plan was to take the lead by using industry leading assembly practices, advanced testing, and data storage. ARMCO is ISO 008 Certified, a member of the American Petroleum Institute (API), Rubber Manufacturers Association (RMA), National Association of Hose and Accessories (NAHAD), and Occupational Health and Safety Advisory Services (OHSAS), and thus dictating only the highest level of standard in both product and production facilities.

After her father’s retirement and sale of his interests, Tiffany decided to venture out on her own. Armed with a five-year plan, a sub-leased building, determination, and an army of friends, welders, electricians, and pipe fitters, ARMCO was born. Her number one plan was to take the lead by using industry leading assembly practices, advanced testing, and data storage. ARMCO is ISO 008 Certified, a member of the American Petroleum Institute (API), Rubber Manufacturers Association (RMA), National Association of Hose and Accessories (NAHAD), and Occupational Health and Safety Advisory Services (OHSAS), and thus dictating only the highest level of standard in both product and production facilities.

Tiffany showed great confidence, sometimes even putting the cart before the horse. She signed a sub-lease on a building, hired staff, and then went to the bankers. Luckily, the five-year plan she presented pleased and impressed the bankers. Confident after so many years of learning from the bottom up, Tiffany was comfortable in every role. “It may sound funny, but I was never scared. I just knew what I wanted and went after it,†says Tiffany.

They say it takes an army to build a village, but in Tiffany’s case (to build her facility , it took a bunch of great friends, dedicated employees, her father, clear direction, and long hours into the night. Within weeks in her shop, ARMCO was manufacturing ARMCO Certified Hose Assemblies and producing custom orders. Business partnerships were forged with leading manufacturers and the backbone was in place and poised for growth.

At ARMCO, being a team is also integral to the overall infrastructure. Jeremy Roberts, Operations Manager, has been working with Tiffany for over 12 years. Brandon Greene, who has been with ARMCO since day one, says, “ARMCO is a family. We look after each other, and we are building a bigger and better team every day.â€

“Belief in the work that we do, the customers we service, and the overall philosophy of the company makes me proud to work at ARMCO. That’s why I’ve been here for so long,†says Shawn Stewart, who became part of the team over four years ago.

Some people might ask if this success comes with being a woman and having a different outlook in this male dominated industry. Tiffany says, “No! I am like everyone else. I make efforts to perfect my craft everyday, forge for better and longer relationships with my business partners and vendors, and I know I can do anything my industry peers can do. Being a women just means more is expected, and that is A-OK with me.â€

“I remember meeting Tiffany about six years ago, and I thought how does this petite, attractive women fair in this dog-eat-dog industry? She looks more like a model than someone who can build a rotary drilling hose,†says her now Director of Sales and Marketing, Maria Martiniello. “After working with Tiffany for over a year, I now know the answer. Tiffany has a love of the industry, her customers (she knows them all personally and by name , and the technology. With her passion and drive, success is the only option.â€

Recently, a pilot show featuring Tiffany and ARMCO called “Working In Her Shoes†was filmed, and it is available for viewing on TELUS OPTIKS (Video on Demand or via Vimeo (view here). The show features ARMCO’s in-house equipment and processes, including all the testing and certifications ARMCO does to ensure quality products always leave the shop. Their product lineup includes land and offshore drilling hoses, hydraulic hoses, oilfield products including rotary, Kelly hoses, choke and kills, BOP, Steam, and fracturing hoses. ARMCO provides hose and fitting products to all areas of the petroleum industry, whether it is upstream, downstream, transportation, or recovery sectors. It is also quite diversified and serves the markets needing drilling, well service, transportation, mining, manufacturing, agriculture, and environmental.

ARMCO strives to exceed the expectation of their clients as well as the capabilities of their competitors. Through innovation, new product development, quality control, and service excellence, they make every effort to be an exceptional leader in the industry. ARMCO takes pride in their dedication to preserving long-term and profitable business relationships, not just with their clients, but their colleagues, service providers, and community.

ARMCO uses engineered conveyance and control products that have a reputation for safe, secure, and rugged performances. They provide testing, certification, and recertification of hose assemblies to meet or exceed industry standards before shipping. This world class hydrostatic test module is capable of 70,000 PSI. ARMCO’s test facility is one of the most advanced in North America. ARMCO certifies assemblies to all major standards including those set out by the Rubber Manufacturers Association (RMA), Department of Transportation (DOT), Certified General Accountants (CGA , American Petroleum Institute (API), Det Norske Veritas (DNV), Society of Automotive Engineers (SAE), American National Standards Institute (ANSI), and the National Association of Hose and Accessories (NAHAD). All certification information is uploaded to the Internet or onto RFID chips, which can be read by any smartphone. In addition, the shop has a wide array of coupling equipment.

Does the apple fall far from the tree? In this case, it didn’t, but that apple has a few tricks it can teach the tree. Tiffany has an amazing appetite, not only to succeed in any job put forth, but also loves a challenge in her personal life. She thrives for any challenge but is also a speed demon. Tiffany and her father Dave have many common interests other than hoses and fittings. Tiffany has introduced her father to skydiving, and they have a common interest in scuba diving. Traveling to destinations known for diving and high-energy activities has been something this pair has shared throughout the years. Tiffany loves to introduce Dave to new and exciting adventures, and he has no problem following in his daughter’s footsteps.

There is always fun to be had around these two, but the conversation inevitably always goes back to hose and rubber composite, fitting suppliers, and the best way to swage a hose. It has been asked by family members to leave the office conversation away from the dinner table, but to no avail. “Once a hoser always a hoser,†laughs Dave as he winks at his daughter.

There is always fun to be had around these two, but the conversation inevitably always goes back to hose and rubber composite, fitting suppliers, and the best way to swage a hose. It has been asked by family members to leave the office conversation away from the dinner table, but to no avail. “Once a hoser always a hoser,†laughs Dave as he winks at his daughter.

Â

We all suffer from the same affliction. We are constantly striving to strengthen the relationships and build the level of trust between our companies, and the E&P and EPCs we are or want to do business with. After all, that’s what leads to more business, isn’t it!

Yet, in doing so, we still have trouble figuring out why we can’t get that next new customer. We are often frustrated when we have other products and services to offer to our customers, that they don’t order or even seem to know about. We think if our prospects would just take the time to get to know our companies a little bit better, they would surely buy from us. Well, we all suffer the same sales and marketing affliction, whether you’re ………

- an Exploration and Production company looking for new investment capital

- an EPC company looking to expand your Operator client base

- a Service and Supply company looking for new opportunities to sell into more Exploration and Production companies

- a Rental company looking for ways to gain a larger share of your Producer’s wallet

- a Manufacturing company looking for new fabrication work with oil patch Service, Supply and Rental companies

Here’s what we are hearing from our new Oilfield HUB members. It’s tough to get noticed, it’s difficult to make contact, it’s hard to get in to see someone, and it’s even harder to break into an existing supply chain. Salespeople for service and supply companies are pounding the pavement in downtown Calgary, and doing a very reasonable job getting in front of the right people in established relationships where product sourcing decisions are being made. But at the same time, they quickly realize when orders are not flowing, that the actual buying decisions are also being made by their customer’s people in the field. How do you reach those folks when they need you and your products and services the most? You do a creditable job in Calgary, but can’t be in front of every superintendent, field supervisor or their field staff when they are making their vendor selections and purchasing decisions. Worse yet, what happens when you don’t have a sales presence in Calgary or near any of these individuals? Then what?

We coined this, “The Tip of the Iceberg Effect”. It’s all about changing market perceptions and established industry paradigms surrounding the many competitors that have come and gone before us, while still battling current competitors that are offering comparable products and services. This is all the stuff above the water line. The information that is easily accessible to all, but likely not strong enough to win over that next new client or order. Sound familiar in your world? Our challenge, how do we educate our customers and prospects about all of the great things we can do, the experience that we have, the expertise we can offer and the entire suite of products and services we can provide? The vast amount of great stuff our customers should know about us, that’s lying below the water line!

Interestingly, we suffer a similar fate with our own sales and marketing efforts when approaching new prospects about Oilfield HUB. At times we are met with an immediate dismissal which leaves us shaking our heads. We’re told we are just another directory, or that their advertising budget has been spent, or we’ve tried services like this before and didn’t get any results.

So we too are battling old market perceptions when selling the value of the HUB; that darn stuff above the water line! So what’s all below our water line? Hmm! If I’ve left you hanging and wanting more, well that’s the Tip of Our Iceberg. Give us a call.

Kevin Turko, CEO Leadstone Group Inc.

There are so many interesting stories in the patch just waiting to be told. Every week we come across cool stories about new and innovative technologies from our Oilfield HUB member companies. But it doesn’t stop there! We are also fascinated by the diverse interests and lifestyles of the owners and their staff, as well as the passion they readily share for their community and the special causes that are close to them and dear to their families. This is truly the heart and soul of the industry!

Yet, every day, oil and gas companies and their service partners are constantly taking shots across the bow in the media from special interest groups and even the entertainment industry. If these were actual arrows, we would never storm the castle for fear of getting wounded or killed by the hundreds of archers standing in the way of our members’ success. We hear tales of the insane amount of money associated with the energy business, but it seems everyone still wants their cut of the action! The industry is continually being bombarded by negative press over very sensitive matters such as environmental impact; along with a multitude of other concerns they must cope with each and every day.

We see it, we hear it, we read about it and talk about it constantly! Yes, these are sensitive issues and real matters that must be properly and expediently addressed by the industry. In our travels around the patch we encounter plenty of great people with honourable intentions, skills and expertise that are doing just that. Yet these people and their companies are being overshadowed by this constant barrage coming at them from every direction. Even more unfortunate are the numerous untold stories of the heroes in the energy business, whose modesty and love for their community goes unnoticed to the public at large.

We aim to change this in the pages and upcoming issues of Oilfield PULSE! We are not just another oil and gas trade magazine vying for your advertising dollars. Oilfield PULSE is the voice of our Oilfield HUB community. We are advocates for the great things that are happening in the industry and the untold stories of the people who truly make it happen!

As you flip through the pages of this issue you’ll see just what we mean. We are very pleased to welcome Ecoquip Rentals and Sales to the front cover of the PULSE. The Grabills, Les and his two sons Chris and Tim, lead this family run business. Get to know them, and it’s not hard to imagine why they are successful. Their company is also surrounded by a great entourage of dealers, suppliers and manufacturers who both contribute and benefit from their association with Ecoquip and the Grabills. We are excited to be able tell some of their stories as well. Thanks gents!

We hope you will find this issue and our approach refreshing, interesting and certainly a change of pace from other industry mags! Whether you’re a service and supply, or an exploration and production company we want to hear and learn more about you. And so do our readers!

And by the way, check out our new mobile version of the magazine and our PULSE Interactive website at www.OilfieldPULSE.com. Now we’re getting the positive words out there that truly count and matter to us all!

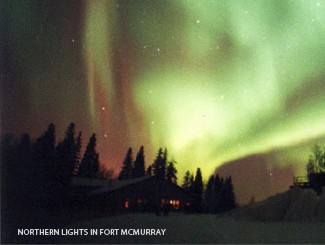

A lot of Western Canada’s oil is hard to get to. Whether it’s tight oil in the Bakken Formation, the oil sands of northern Alberta, or heavy oil around Lloydminster, Canadians have brainstormed new ways to produce unconventional crude oil.

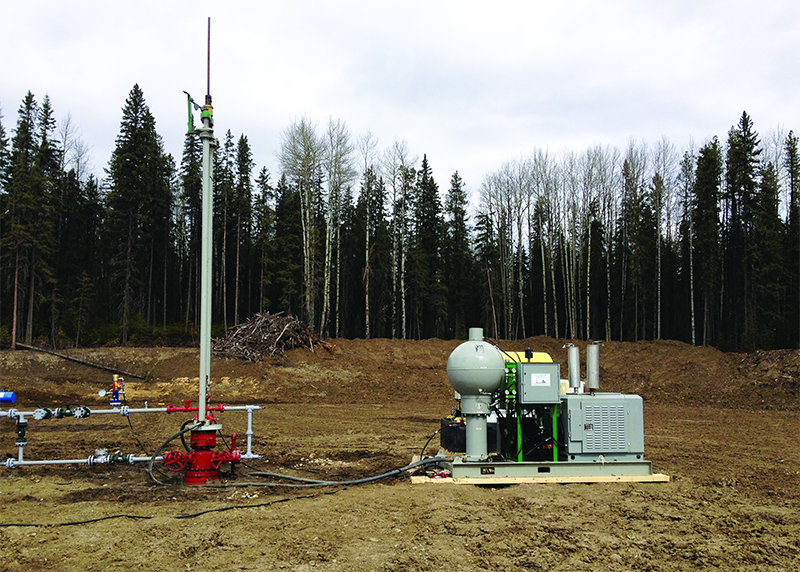

One of the technologies that emerged from Western Canada is the hydraulic pump jack.

Everyone is familiar with that old standby of oilfield production, the pump jack, with its distinctive horse-head nodding up and down, day and night, powering the pump located thousands of feet beneath the surface. There are thousands of oil wells in the West and many of them will be produced using pump jacks.

Sometimes, the simple pump jack isn’t the best option.

In that case, producers are turning more and more to hydraulic pump jacks like the ones manufactured, distributed and serviced by Ecoquip Rentals and Sales Ltd. Oil patch veteran Les Grabill and his partner Glen Schultz founded the company in Calgary in 1992. Grabill found himself laid off for the first time in 28 years and decided to turn bad luck into a good opportunity. He started selling used oilfield equipment and did well. But as luck would have it, a couple of inventors with a new idea for a hydraulic pump jack stumbled across his path and he was intrigued by their concept.

Over a period of 7 years, Les Grabill and Glen Schultz took over the development of the pump jack amongst other business activities, but decided to go fully commercial with the pump jacks in 2000. Les has since entered semi-retirement in 2006, but eldest son Tim remains as President of the operating company and has been involved with the expansion of the company since 2002, while his other son Chris came on board in 2006 and serves as Vice-President of Operations.

Over a period of 7 years, Les Grabill and Glen Schultz took over the development of the pump jack amongst other business activities, but decided to go fully commercial with the pump jacks in 2000. Les has since entered semi-retirement in 2006, but eldest son Tim remains as President of the operating company and has been involved with the expansion of the company since 2002, while his other son Chris came on board in 2006 and serves as Vice-President of Operations.

How does an Ecoquip hydraulic pump jack work? Pretty much like a car’s braking system. Press your car’s brake pedal and fluid moves from the master cylinder to the wheel cylinders. Release the pedal and the fluid flows back to the master cylinder. Something similar happens with the Ecoquip hydraulic pump jack.

The system has two primary components: the slave cylinder that mounts on the wellhead and a skid-mounted power unit. The power unit contains a master cylinder with four chambers, two slave cylinders that move the polish rod, a positive displacement swash plate-type hydraulic pump, motor and control panel.

Chamber A in the master cylinder displaces fluid to the slave cylinders, forcing them to rise as the master cylinder piston moves downward. Chambers B and C add energy to the system. Chamber D is the accumulator and stores pressurized nitrogen, which stores energy as the polish rod moves down, then uses that energy to help move the polish rod during the upward stroke.

Les Grabill says the Ecoquip system replaces the old-style method of using a valve to reverse the fluid flow when changing from one stroke direction to the other. That system created pressure spikes and heat that over time (sometimes not much of it), caused the system to prematurely fail.

That’s why in the early days, customers mostly wanted to rent rather than buy hydraulic pump jacks. Renting made sense for early adopters, minimizing their risk and giving them a chance to become familiar with the technology. In theory, if the new widget doesn’t work as advertised, the producer can always give it back and stop the rental payments.

Fortunately for Ecoquip, the rentals were a big hit with customers. Ecoquip has seen a trend that as the hydraulic pump jacks proved themselves; customers were more inclined to buy rather then rent.

“We started out thinking we were always going to rent and act like a service company, but companies saw the value and pushed us to build more and sell. Five years ago I would have said we had 35% of our fleet sold and 65% rented. Now it’s flipped, if not higher than 65% sold,†Chris Grabill said, “More companies are comfortable buying our units and moving them, servicing them themselves, finding the use and reliability of them very beneficial.â€

The rental model was also good for Ecoquip because it provided cash flow and allowed the company to cautiously develop the technology, test it and prove it without the need to rush it into the marketplace.

Ecoquip’s hydraulic pump jacks have four major advantages over competitors:

The company is poised for a significant expansion over the next few years. Now that the development and testing phases of the hydraulic pump jack have been proven over 15 years and the product has been well accepted in the Western Canadian market, the time has come to get serious about building out their dealer network and exploring new markets.

“We have a dealer in Manning, Alberta, Leading Edge, who has their own rental fleet of our pump jacks and takes care of rental and sold units north of Grand Prairie and I’d like to replicate that type of relationship in Saskatchewan and North Eastern Alberta,†says Tim. “The Bakken area, as everyone knows, is blowing up and the best way for us to get in there is not to set up a branch, but to give the knowledge base to some local providers and give them the opportunity to represent our equipment.â€

Ecoquip has had plenty of interest from international customers and exporting is definitely in the company’s future.

“In Canada, we’ve just scratched the marketplace that is there†explains Chris. “We have not expanded into the international market yet, which is a huge opportunity. I feel the Ecoquip hydraulic pump has a budding opportunity at this stage.â€

“We have the 9000-6 unit that is a really good fit for many applications because it covers such a wide range of other conventional pump jacks. The power unit is about the size of a small sedan,†says Tim. “It compares to a number of conventional pump jacks from 114 to 912 pump jacks, we’re significantly smaller but equally as powerful. With our recent developments we have further increased our stroke length to 158â€, SPM can range from less than 1spm to greater than 8spm depending on stroke length with polish rod loads up to 35,000 lbs. And we’re also easily mobile, which is a big advantage for producers in remote areas. Sizing of pump jacks has become a thing of the past when we can offer so much in one unit.â€

With Steam Assisted Gravity Drainage slowly becoming a prominent method of production in the Alberta oil sands, Ecoquip expects SAGD to become a larger market. “We also have a 9000-9 unit that can do a 240†stroke and PRL of 60,000 lbs. and has all the features and power of our other units. This long, controllable, reliable stroke is the best option for pumping oil sands applications,†says Chris.

For lower producing wells, Ecoquip is working on a smaller design which will meet the price point for this market but still give their customers the reliability and service they have become familiar with.

Ecoquip is a classic Canadian oil patch story of innovation and perseverance. After 20 years innovating, testing, renting, selling and servicing under founder Les Grabill, the company is ready for a major expansion under his sons Tim and Chris.

Touring the new Plains Fabrication and Supply 90,000 sq. ft. shop located on Venture Avenue, near the southeast edge of Calgary, it becomes readily apparent that the pride, commitment and quality are the main focus of all employees throughout the company.

Calgary’s Plains Fabrication and Supply has been successful over the company’s 24-years spent manufacturing mostly pressure vessels and pressure piping. Their products largely wind up in the oil fields of northern and southern Alberta, though they have occasionally landed in far flung oil producing locales in other parts of the world.

Calgary’s Plains Fabrication and Supply has been successful over the company’s 24-years spent manufacturing mostly pressure vessels and pressure piping. Their products largely wind up in the oil fields of northern and southern Alberta, though they have occasionally landed in far flung oil producing locales in other parts of the world.

Touring the new Plains Fabrication and Supply 90,000 sq. ft. shop located on Venture Avenue, near the southeast edge of Calgary, it becomes readily apparent that the pride, commitment and quality are the main focus of all employees throughout the company. Plains is a business that has been built on the efficiency, innovation, and co-operation of a group of dedicated owners, employees and industry connections.

Anyone not impressed by the sight of a team of welders assembling a 12 ft diameter x 60 ft long pressure vessel is either plain jaded, or works on the shop floor and is accustomed to seeing them put together all the time. The vessels, when packaged and finished, are bound for the oil sands.

On its own, the pressure vessel is like a work of art, for the precision steel work and oblong shape. Pondering the know-how and skill involved in its assembly is fascinating, and this is just the smaller scale of the pressure vessels and piping packages that Plains has been manufacturing since 1988.

Currently, the fabrication company is going through a marked period of growth and re-organization, hence the move to a new plant on Venture Avenue. While the company is expanding, its aim is to become as efficient and eco-friendly as possible.

It all started in the late 1980s, when current President and CEO Chester Nagy along with several others founded Plains Fabrication and Supply from the ashes of a preceding company. Nagy and the fellow founders decided to correct the mistakes of its forebear and invested in building a newer, better, smarter manufacturer.

So, from 1988 until 2010, the Plains shop resided in the Ramsey Saddleview Industrial Park, near the Stampede Grounds in the heart of Calgary. Plains has successfully moved on from that location and they have never looked back. The main reason for the move was Ownerships ability to realize the Ramsey location was no longer a viable option if the company was to grow and improve its production techniques. The shop was getting too small for the volume of production. Also, the inner city location was creating its own difficulties, and the result was the company turning away as much work as it was taking in.

To Nagy, the partner who owns the largest stake in the company, a change needed to be made.

The goal of the Ownership was to take the combined experience of its employees and industry to build a plant that allowed the company to produce a superior product using the most efficient and effective manufacturing techniques.

We were facing the ever growing problem that we were simply not able to ship the size of the product from the Ramsey location, explains Herb Hammer. There were too many restrictions. Even the simple cost of moving some of the equipment we built from the old shop to the new shop was 10’s of thousands of dollars just to move it to the city limits.

Tom McCaffery, General Manager, adds, “In the old facility everything had to move in one direction, and once it was in line it had to stay there even if there were issues preventing it from moving to the next phase of production. Everything had to go in and come back out the same door. There was no way around it. Here, in the new facility, the guys on the floor have the flexibility to move the product, but the goal is for it to only move when it’s absolutely necessary. The less we move it, and the more we feed the plant to continue the required work, the more successful the job becomes.”

There are multiple assembly bays in the new, massive Plains building. Each has a similar set-up and is configured the same way with identical electrical wiring and tool stations. Not built just for the sake of spectacle, the extra space helps prevent common work delays in custom steel fabrication, and allows Plains to have complete flexibility to make changes if the situation calls for it.

“If there is a change or long delay the product can be moved outside very efficiently so we don’t end up with large vessels or skid package consuming valuable space with employees waiting for issues to get resolved. We have to be flexible enough, that if that job stops, we need to be able to move everything to continue production regardless of an individual package that may need a drawing approval.”

While at the Plains facility, one often hears the word “lean” when describing the new operations. They are referring to lean production principles, a model highly-influenced by the Toyota Corporation. It focuses on maximizing efficiency, not in terms of skimping to keep prices as low as possible, but to attain peak workflow potential, avoid wasted time, and reduce material waste.

While at the Plains facility, one often hears the word “lean” when describing the new operations. They are referring to lean production principles, a model highly-influenced by the Toyota Corporation. It focuses on maximizing efficiency, not in terms of skimping to keep prices as low as possible, but to attain peak workflow potential, avoid wasted time, and reduce material waste.

The drive towards the lean model was kick started by Chester Nagy, who was inspired by reading about other successful companies that instituted the principles. If Plains was to become truly lean, it would need a new facility. But in designing that facility to be as efficient as it could be, Nagy again followed the lead of other lean companies and sought the input of his entire company, making employees party to the planning and design of the new building. Who would know better about what happens on the manufacturing line than the people who actually work there?

“A lot of the input was from the guys on the shop floor and in the office, trying to design the workflow to be the most efficient that it could. Part of lean is trying to eliminate waste. The less we can handle a product, the more work we can do on the spot. We’ve been able to eliminate hours and hours of handling. Now it’s just a matter of moving a project down one station or leaving it in one station and doing multiple tasks in that one spot,” explains Hammer.

Unlike a typical factory, being a custom steel manufacturer presents its own difficulties when it comes to achieving the best efficiency. “If we were just making widgets all day long, we could just stand back, look at the process, analyze it, and make improvements based on one design and one product, but each vessel we build is different from the one we built the day before. Each customer has a whole new set of specs, so it’s a complicated process to try to make lean work in the traditional sense,” says McCaffrey.

“We’re continuously working on improving scheduling, or trying a new assembly system, and it all evolves from our staff on the floor and in the office. We live in this perpetual system of looking for potential issues and working as a team to see what we can do to get better and improve. It’s a positive and empowering place to be.”

“We’re continuously working on improving scheduling, or trying a new assembly system, and it all evolves from our staff on the floor and in the office. We live in this perpetual system of looking for potential issues and working as a team to see what we can do to get better and improve. It’s a positive and empowering place to be.”

The quest to cut down on waste goes well beyond workflows. It permeates into the little things, like how they began composting lunchroom waste at the recommendation of the company’s Green Committee.

More importantly, though, Plains practices recycling and material waste reduction on an industrial scale, proving that an operation of its size can successfully introduce green methods. The new state-of-the-art blasting technology instituted at the new plant has dramatically reduced the amount of industrial waste by replacing old sandblasting methods. A self-contained blasting chamber prevents dust from going into the atmosphere. The blasting materials have changed as well.

“In the old facility we used silica sand to blast,” explains Hammer, “We would use it once, then have to dispose of it, so we would have to have somebody come in and take all the sand away. Now we use steel slag to do our blasting that we can re-use up to 250 times. We have a 45-gallon drum that gets trucked away for recycling every two or three weeks and we don’t have to worry about putting thousands of pounds of sand every year into the land fill.”

It adds up. They estimate that they have reduced their yearly waste to the land fill by over 100 tons from the old facility.

“We learn from other people and co-operate with competitors and customers because we believe that’s how we grow as a company and that’s how we’ll grow as a country, industry-wide,†McCaffery summarizes.