| Date Published | December 15, 2014 |

| Company | National Bank of Canada |

| Article Author | Jim Wallace |

| Article Type | PULSE Interactive Newsletter Dec. 2014 |

| Category | PULSE Interactive |

| Tags | Fuel Hedging Program, Hedging Tools, National Bank of Canada, Rack Prices |

| HUB SEARCH | NationalBank |

There has been significant price volatility over the past several years in energy markets. Budget planning and achieving financial targets can become a real challenge when faced with the unpredictability of energy prices. Increasingly, management teams are being asked to find ways to reduce their exposure to this volatility and manage the risk associated with rising fuel costs.

There has been significant price volatility over the past several years in energy markets. Budget planning and achieving financial targets can become a real challenge when faced with the unpredictability of energy prices. Increasingly, management teams are being asked to find ways to reduce their exposure to this volatility and manage the risk associated with rising fuel costs.

Subsequent to the November 27th meeting in which OPEC announced it would maintain current production levels, fuel prices have continued to fall. Continued downward pressure on crude oil and associated products in global markets has created opportunities for consumers of these products to lock in costs at prices well below those that have prevailed for the past 3 years.

Financial market products have continued to evolve such that hedging tools are available to assist in managing fuel price risk. Transportation companies continue to be active users of fuel hedging products. More recently, energy service providers have become increasingly active in managing their fuel price risk in efforts to manage input costs and better protect operating margin and cashflow.

Companies with truck fleets can purchase their diesel fuel based on rack prices which include location costs for transportation to various delivery points. The most common hedge index used by Canadian consumers to protect their diesel fuel costs is the monthly NYMEX ultra low sulphur diesel (ULSD) index price. Companies can use financial hedging instruments to minimize the volatility associated with fuel price movements. A certain level of basis risk does exist (the difference between the hedge index price and rack price) however, NYMEX ULSD hedge index has historically had a strong (+90%) correlation to Alberta rack diesel prices. As such, while existing financial instruments cannot provide a perfect hedge against Alberta rack prices, they do serve to reduce significantly the financial impact on fuel price movements. These financial instruments are typically set up as contracts with specific monthly volumes, for a specified term, at a pre-determined price.

Financial Instruments Used in the Industry:

• Fixed Price Swaps

• Call Options

• Zero Premium Collars

How to Establish a Fuel Hedging Program:

• Determine a price level you want protected

• Determine the commodity, volume, and term you want to protect

• Determine the financial instruments to best manage your risk – Fixed Price Swaps, Call Options, or Zero Premium Collars

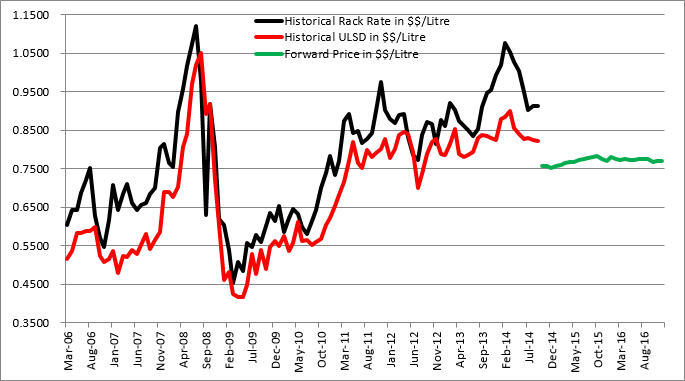

Historical Financial Instrument NYMEX ULSD pricing vs. Alberta Diesel Rack pricing and the Forward NYMEX ULSD price:

Historically the Alberta rack price has traded slightly above the NYMEX ULSD price used (Red line). The financial hedge effectively fixes the ULSD price but the Company remains exposed to the difference between the Alberta rack price and the ULSD price (basis). Given recent softening in global crude markets, the forward price (Green line) is currently at prices lower than companies have experienced from early 2011 through 2014.

National Bank’s representatives would be pleased to assist your company with the development of your fuel hedging program.